You're not just paying tuition...

you're paying Someone Else's mortgage.

AS

SEEN

ON

Over the next 4 years, you’ll spend

$40,000–$100,000 on dorms and rent…

and walk away with nothing to show for it.

But what if every housing dollar could build your family’s equity

instead of lining someone else’s pocket?

IMAGINE:

Safe + Stable: Your student has a reliable home base—

no more shared hallways or surprise dorm fees.

Mortgage Covered: Roommates pay the mortgage—

no more rent checks, just equity in your family’s name.

Profit Potential: After graduation, it’s YOUR choice—

sell for profit or convert to long-term cash flow.

DORMS TO DOLLARS:

How To Make Money During The Most Expensive Years Of Your Child’s Life.

An eBook that walks you through every step of becoming a confident college parent landlord.

Get Instant Access to

Dorms To Dollars

DORMS TO DOLLARS: How To Make Money During The Most Expensive Years Of Your Child’s Life

You’re so focused on scholarships… you don’t see housing quietly draining your bank account.

While you're chasing tuition discounts and filling out FAFSA forms, housing is quietly eating away at your savings $10K–$25K+ a year — with zero return.

It’s the most overlooked money drain of the college years. By the time you notice, you’ve already spent tens of thousands — and built equity for someone else’s future, not your own.

You worked too hard to save money. Don’t let rent take it all back.

How many times have you WINCED at writing a check for a dorm room the size of a closet — knowing it’s money you’ll never see again?

Yeah, we’ve been there too.

How many times have you THOUGHT about buying a rental… but gave up because it sounded overwhelming, like becoming a full-time landlord overnight?

We hear this from parents EVERY.SINGLE.WEEK

Meanwhile, you’re PAYING top dollar for college housing, and your family isn’t getting a penny back. It feels like pouring money into a bottomless pit.

Somewhere, a landlord just raised the rent.

And that’s exactly why most parents never take the leap into college housing — they think it’s too complicated, too risky, or too late. (Spoiler: it’s not.)

No One Warned You That the Real Money Pit in College Isn’t Tuition… It’s Rent.

You braced yourself for tuition… but it was the housing bill that left you reeling.

That first check? It felt like a gut-punch — It could’ve been a mortgage payment. An investment. A smarter move.

Now the shock has worn off, but the math still stings. And that nagging thought won’t go away:

THERE HAS TO BE A SMARTER WAY...

Most parents are so focused on tuition that they BARELY QUESTION housing — they just accept it as another line item. But college housing is the single biggest overlooked expense

Meanwhile, off-campus rent easily runs $1,000+ per month. Stretch that over 4–6 years if your child goes on for a master’s, and you’ve just poured TENS OF THOUSANDS into housing… with nothing to show for it.

And every dollar you spend is building someone else’s mortgage — NOT YOURS.

Here's The Hard Truth

Forget the repeating expenses with nothing to show

HIdden Cost...

Average room & board? $12,770/year

WEalth Drain...

4 years of college?

Over $50,000 — Gone!

Money PIT...

Add Grad school? Add 2 more years of rent = $75K+ — with ZERO RETURN!

There’s a SMARTER WAY — It doesn’t start with scholarships or cutting corners.

It starts with OWNING the property instead of renting it.

Yeah, I get it — it feels big and a little scary. But here’s the thing: housing

is the ONLY COLLEGE COST you can flip from a money suck into an investment.

The issue is that most parents that want to own a property will go out on their own and just figure it out as they go along. THAT'S NOT EUN!

You need reliable, easy to understand and a big picture account of what it’s really like-from an actual parent landlord.

Wouldn't it be nice to have THE CONFIDENCE THAT YOU KNOW WHAT TO DO?

The Issue Boils Down To...

Problem No 1

I HAVE NO CLUE WHERE TO BEGIN....

You're thinking about the idea. But then reality kicks in: How do I actually do this? Do I just... buy a house? Rent it out? Become a real estate mogul overnight? The whole thing feels overwhelming, and let’s face it, you don’t have the time (or energy) to figure it out alone. It’s like trying to put together Ikea furniture without instructions—it’s a lot.

Problem No 2

CAN I AFFORD THIS?

You’re already juggling tuitionand other college costs, not to mention everything else at home. The idea of adding a "project" on top of that feels... well, daunting. “How much will the down payment be? What if we can't cover the monthly payments? Is this going to be a financial stretch?” These are the real questions keeping you up at night, and it’s hard to make a move when you don’t know the numbers.

Problem No 3

WILL THIS EAT UP MY TIME?

Even if you’re on board, there’s this nagging thought: “What if this turns into a total time-suck?” You’ve heard the horror stories -tenants with broken toilets at 2 AM, endless repairs, and worrying about getting rent on time. You’re already juggling a million things, and the last thing you need is this turning into a second full-time job.

Busy parents need something that is EASY and PROVEN.

Dor

We were floored when we saw how much dorms cost per year. Instead of throwing it away, we bought a small rental near campus. Our child had a safe place, their roommates covered most of the mortgage, and now we have a property that's gained value. It turned out to be the smartest move we've made as parents.

--MISTY

I have been thinking about this for years but had no idea where to start. Dorms to Dollars broke it down step-by-step and gave me the confidence to finally move forward. Instead of feeling overwhelmed, I feel like we are in control of college costs now.

- ANDREW

We crunched the numbers and realized we'd spend over $50K on dorms. Instead, Dorms to Dollars helped us buy near campus. With roommates covering mortgage, we saved tens of thousands—and still own the house when graduation comes

- SARAH & MICHAEL

The good news is that YES… there is a way to:

Gain perspective of the entire process of being a parent landlord.

(Without searching the online for hours on every question and solution.)

Understand how to finance as an investment and get tax breaks.

(instead of pumping money you'll never see again into someone else’s pockets)

Managing a rental without it being a complete time suck.

(Honestly, we’re finally getting kids out of the house, we really do want some free time back)

There is a simple solution that even the busiest parents can use to create a profitable college rental and build wealth

And it doesn’t matter if your child is already in college

or just about to get started

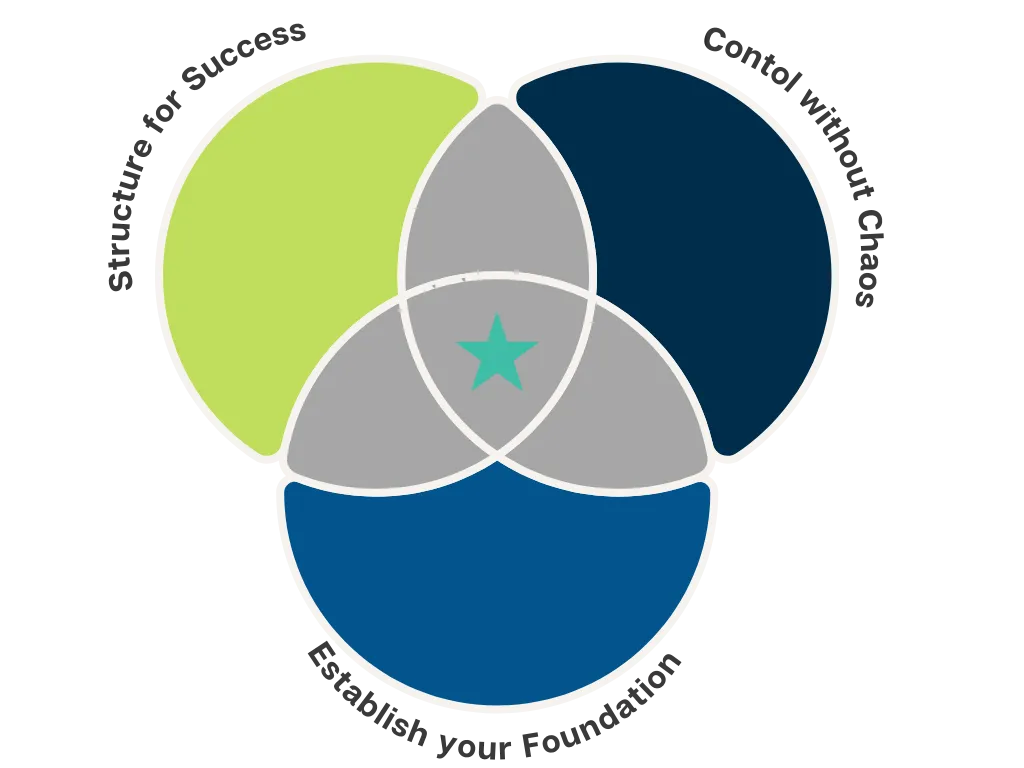

First...

ESTABLISH YOUR FOUNDATION—a clear, well-researched plan for the investment process.

Think of this like the foundation of your house. Without it? Cracks start to form, things get wobbly, and the whole structure is at risk.

→ What makes a college rental a smart investment (and what to avoid)

→ How to choose the right property—without guessing

→ The crucial financial factors that set you up for long-term success

A strong foundation ensures every decision moving forward is built on stability and smart planning.

Second...

You'll need STRUCTURE FOR SUCCESS—taking your investment from an idea to a fully functioning, money-making rental.

This is like framing the walls and putting on the roof—it shapes the entire structure and determines its strength.

→ Renovate with purpose (so you’re not overspending on upgrades that don’t increase value)

→ Price & market the property strategically (to attract the right tenants fast)

→ Create a seamless rental experience (so tenants stay longer, and you avoid constant turnover)

Skipping this step? Even the best foundation won’t hold up. You need a strategic planning that ensures every move is intentional, profitable, and built for long-term success.

Third...

CONTROL WITHOUT CHAOS—a streamlined way to manage your rental without it taking over your life.

This is where you add the finishing touches—the systems that keep everything running smoothly so you’re not constantly putting out fires.

→ A simple, repeatable system for handling maintenance & repairs before they become emergencies

→ A structured process for tenant turnover that avoids last-minute scrambling

→ Clear communication methods so you’re not bombarded with texts at all hours

Without reliable management, even a well-built investment turns into a massive time suck. The key is having the right structure in place—so you stay in control without the chaos.

TL;DR

Think of these stages as building blocks—each one supports the next.

You can’t skip steps, and one won’t work without the others.

Dorms to Dollars Have you heard about it? Dorms to Dollars Save Money on College Costs.

You’ve got enough on your plate. Let us help make this process SIMPLE, so you can FOCUS on what really matters: making SMART financial moves—without the headache.

"I highly recommend for any parent looking to invest in a college rental."

- BRENT S.

"I had no idea where to start when we bought a rental property for my daughter, but this book made it simple and straightforward."

- CHRISTINE R.

You need ALL three, because just two out of three…the system breaks.

Establish Your Foundation + Structure for Success (-Control Without Chaos)=

You have accurate views of your to-do’s and time but don’t stick to your plan (hello accountability)

Structure for Success + Control Without Chaos (-Establish Your Foundation)=

→ You have a rental that’s running smoothly, but without a strong investment strategy upfront, you risk picking the wrong property, overpaying, or struggling to turn a profit.

(Hello financial headaches!)

Establish Your Foundation + Control Without Chaos

(-Structure for Success)

→ You’ve done the research and set up a management system, but without the right renovations, pricing, and marketing, your property underperforms.(Hello missed potential!)

Dor

I was nervous about managing everything, but Dorms to Dollars made it simple. Instead of stressing over the unknowns, I knew what to do and when to do it.

SIMONE P.

We followed the Dorms to Dollars strategy to buy a property near campus. Our child’s friend rented the extra rooms, which covered the mortgage. What used to feel like a money drain became one of the smartest financial moves for our family.

ROBERT & KELLY S.

Want to skip the overwhelm and finally learn how parents are turning rent money into equity — without endless Googling

EXACTLY

Let’s be real — housing bills drain your wallet fast, and Google can’t solve it. We’ve lived it, wasted money on it, and built the system to fix it.

This step-by-step guide shows you exactly how to flip those costs into an investment — with zero confusion and 100% confidence.

….

INTRODUCING.....

Dorms To Dollars:

How to Make Money During the

Most Expensive Years of Your Child’s Life

Dorms to Dollars is the parent-to-parent guide to flipping the most expensive years of college into an investment opportunity.

Even if you’ve never owned a rental before, this eBook walks you through the entire process — simply, clearly, and without jargon. Written by a parent who’s successfully done this for 8+ years, it’s the exact roadmap I wish I had when our oldest started college

Stop bleeding money on dorms & rent — redirect it into equity your family keeps.

Learn the step-by-step system for buying and managing a college rental (without becoming a full-time landlord).

Confidently move from idea to action with a clear, proven process — no guesswork, no overwhelm.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Nulla non augue a dolor convallis lacinia. Aliquam massa mi, consectetur vitae semper vitae, interdum et est. Fusce eget nisl ultrices, efficitur augue sagittis, auctor ipsum.

- JANE AWESOME

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Nulla non augue a dolor convallis lacinia. Aliquam massa mi, consectetur vitae semper vitae, interdum et est. Fusce eget nisl ultrices, efficitur augue sagittis, auctor ipsum.

- JANE AWESOME

Here are the problems that Dorms to Dollars can solve for you NEAR-INSTANTLY…

Number One

THE PROBLEM OF WHERE TO START

Comprehensive Roadmap: From start to finish, covering all the steps involved in investing in a college rental. It takes the mystery out of the process by clearly outlining what needs to be done at each stage, so you don’t feel lost or overwhelmed.

Location Research Insights: Teaches you how to choose the best college towns for investment by evaluating enrollment trends, local economies, and real estate demand, ensuring you make informed decisions from the start

Real-World Examples: With real-world case studies and examples, Dorms to Dollars illustrates common scenarios you may encounter, so you know what to expect and how to handle different situations.

Number Two

THE PROBLEM OF Money & Finance

Creative Financing Options: Dorms to Dollars covers different financing methods, including traditional loans, FHA options, HELOCs, and VA loans, making it easier to find a solution that fits your financial situation.

Income Potential Strategies: It discusses ways to maximize rental income, including charging by the bedroom, offering furnished units, or using short-term rentals during peak university events to generate extra revenue.

Understanding Cash Flow: The book teaches you how to calculate potential cash flow and expenses accurately, so you know exactly how much money you'll need upfront and what you can expect in terms of monthly income.

Number Three

THE PROBLEM OF HOW TO MANAGE IT EFFICIENTLY

Efficient Property Management Techniques: We cover time-saving strategies for managing your rental, such as using property management software to minimize your hands-on involvement.

Time-Saving Renovation Advice: Including advice on choosing low-maintenance materials and durable upgrades, so you can spend less time dealing with repairs and upkeep over the long term.

Clear Expectations and Lease Agreements: The book emphasizes the importance of setting clear expectations and creating solid lease agreements upfront, which can prevent time-consuming disputes and reduce tenant turnover.

Plus some extra side perks that happen as a result!

And The Extra Perks!

Free (or nearly free) housing for your student

Tax breaks most parents don’t even know exist.

Building Wealth While Your Kid Earns Their Degree

A Recession-Resistant Income Stream that keeps working even when markets dip

Property Appreciation Over Time

Leverage Equity for Future Investments

Passive income potential that grows with time.

Valuable Real Estate Knowledge

A lasting family legacy — something bigger than just a dorm payment.

What People are saying about Dorms to Dollars

"As parents, we were nervous about our child living off-campus, but Dorms to Dollars made the process seamless. Not only did we secure safe and reliable housing, but we also turned it into a smart investment. Now, we have an appreciating asset instead of throwing money away on dorm fees!"

MARK & LISA T.

"One of our biggest concerns was finding a safe and well-maintained place for our daughter. The Dorms to Dollars book helped us find a rental property that met all our needs—secure, close to campus, and in a great neighborhood. The peace of mind was priceless!"

JOHN C.

No More Guesswork. No More Overwhelm. Just a Clear, Smart Path to Success.

First.....

FINDING Your Perfect College Rental Property

We kick things off by helping you find the perfect college rental property. Whether it’s a place for your kid or a smart investment, we’ll guide you through the process of choosing the right location, understanding what makes a property profitable, and evaluating options like a seasoned pro. No need to guess—we’ve got your back.

You'll Learn:

How to find the best location for college rentals

How to evaluate properties confidently and easily

The different financing options available

Second.....

Setting Up Your Rental Business for Success

Now that you’ve got the right property, it’s time to treat it like a business—because that’s where the real wealth-building happens.

We walk you through exactly how to set up your rental the right way, from forming an LLC for liability protection to setting up a business bank account to keep your finances streamlined.

This step ensures you unlock tax benefits, protect your assets, and make managing your rental property simple.

You'll Learn:

Essential steps to establish your rental as a business

Task prioritization

How to organize your finances with a dedicated business bank account

Third.....

Stress-Free Property Management

Finally, we tackle the question

every parent landlord has: "How do I manage this without it taking over my life?"

We cover everything from finding reliable tenants to handling maintenance—so you can keep things running smoothly without the stress. Whether you self-manage or hire help, you’ll walk away with a foolproof system that keeps your rental hassle-free.

You'll Learn:

What to do when welcoming tenants

Easy ways to handle maintenance and repairs

Keeping the whole rental process hassle-free

"Instead of throwing money away on expensive rentals we invested in a property near campus. Our kid had a stable home, and we turned a college expense into a profitable investment. It’s been a win-win!"

- TONY D.

"We live out of state and worried managing a rental would be impossible. Dorms to Dollars showed us how to set up property management services so we're not stressed out about repairs and tenants. It's been smooth, simple, and worry-free.

- JULIE T.

Make Your Hard Earned Money work for you!

In addition to this, we’ll stack you up with some simple bonuses that make Dorms to Dollars EVEN BETTER!

BONUS #1 The Big List Of Business Tasks Prioritized

Eliminate the decision fatigue around certain business tasks. This list is the full stack of typical business owner tasks, categorized by priority. It also includes a time estimation so when you’re planning your weeks, you can create a realistic plan! It works for all types of online business owners!

BONUS #2 Crush It With Google Calendar

The best free calendar available today is Google calendar, and this class will give you basic setup instructions as well as some “power user” hacks you may not know yet that will make using the calendar app and tool a breeze.

BONUS #3 Come With Me As I Quarterly Plan!

Using the About Darn Time system, watch me quarterly plan inside our company Funnel Gorgeous. We are a multi-million dollar brand and use this simple system every 90 days so I am CLEAR on what I have to do as Co-CEO after setting up the quarterly priorities. Proof this works whether you are a 1 person show or have a big team!

Stacked With Parent-Proven Bonuses

Bonus #1

Market & Location Analysis

Valued $24

Bonus #2

Smart & Simple Rental Research Sheet

Valued $47

Bonus #3

Top 10 Mistakes Parent Landlords Make (& How to Avoid Them)

Valued $29

TOTAL VALUE = $197.00

Regular Price = $97

Today’s Price Only

$27

Talk About A Guarantee

If You Are Not 100% Satisfied.

Zero Risk. 7-Day Money-Back Guarantee.

If you don’t feel clearer, more confident, and ready to take action within 7 days—simply email us. You’ll get your money back, no questions asked.

Frequently Asked Questions

for Dorms To Dollars

Why should I get the Dorms to Dollars book?

Because you’re tired of burning money on dorms and want a smarter play. Dorms to Dollars is your step-by-step roadmap to transform housing costs into an investment — written by parents who’ve actually done it.

How can Dorms to Dollars help me save money on college housing?

Instead of paying another landlord’s mortgage, you can flip the script. Your student lives in the home, roommates cover expenses, and you turn ‘rent money’ into ‘equity money. You don’t need a big budget—this guide teaches how roommates and smart financing can turn costs into gains.

Is this book helpful if I don’t have experience with real estate investing?

Absolutely. Most parents who use this system started with zero experience. We break it down Ikea-instruction style — no jargon, just clear, parent-friendly steps

Can Dorms to Dollars help me start a rental property business?

Yes — if you want it to. Some parents stop at one house, others build on this model to create real estate income for years. We’ll show you the foundation so you can decide how far you want to take it

IT'S TIME TO THINK ABOUT COLLEGE HOUSING COSTS DIFFERENTLY.

D

"This book was exactly what I was looking for. I've heard of parents doing this and I wanted to know more about the process before jumping in."

-RITA & BOB S.

After graduation, our child moved to another city, but we kept the rental as an income-producing asset. Now, it continues to generate rental income and has increased in value. What started as a way to save on dorm fees became a great long-term investment!"

- JAMES & OLIVIA P

Stacked With Parent-Proven Bonuses

Bonus #1

Market & Location Analysis

Valued $24

Bonus #2

Smart & Simple Rental Research Sheet

Valued $47

Bonus #3

Top 10 Mistakes Parent Landlords Make (& How to Avoid Them)

Valued $29

TOTAL VALUE = $197.00

Regular Price = $97

Today’s Price Only

$27

Make Your Hard Earned Money work for you!

It's YOUR turn to take control of your child's college experience and transform their housing costs into a SMART investment.

Somewhere, a parent just sighed while writing another check to the university.

Every dorm check hurts—but your student’s housing doesn’t have to be a loss.

Grab Dorms to Dollars for just $27 today,

and start turning what you spend into something that grows

Your future self (and your bank account) will thank you.

xx, Gwen

Stacked With Parent-Proven Bonuses

Bonus #1

Market & Location Analysis

Valued $24

Bonus #2

Smart & Simple Rental Research Sheet

Valued $47

Bonus #3

Top 10 Mistakes Parent Landlords Make (& How to Avoid Them)

Valued $29

TOTAL VALUE = $197.00

Regular Price = $97

Today’s Price Only

$27

Get Educated, Know the Process & Feel Confident! Make your Money work For You!

"Our son was struggling with noisy dorms and lack of space. Through Dorms to Dollars, we found a great rental where he could focus on his studies while still having roommates. The quality of life difference was night and day!"

- LISA B.

"We have two kids attending the same university, so we purchased a property after reading Dorms to Dollars. Both of them had a great place to live, and now that they’re graduating, we have a rental property that continues to generate income. It was the smartest decision we made!"